Cash-strapped Taliban look to airspace for windfall – World

Far above Kabul, the cash-strapped Taliban government has located a potentially lucrative revenue stream: Afghanistan’s airspace.

As Israel and Iran’s exchange of missiles threw flight paths into disarray this year, the skies above Afghanistan offered carriers a less turbulent and faster route to ply — for a flat $700 overflight fee, according to industry insiders.

The US aviation authority eased restrictions on the country’s airspace and paved the way for commercial flyovers in 2023, two years after the Taliban takeover.

Airspace that had long been avoided — as the country endured four decades of war and shifting powerbrokers — suddenly became a viable option, allowing carriers to abbreviate routes and save on fuel costs.

But it was not until the 12-day war between Iran and Israel in June that the route really gained traction, allowing the Taliban government to potentially rake in millions.

Faced with shuttered airspace over Iran and Iraq, and unpredictable openings and closures across the Middle East, airlines saw reason to divert course and found refuge over Afghanistan.

While missiles clogged the neighbouring airspace, “the risk of flying over Afghanistan (was) virtually zero”, said France-based aerospace and defence consultant Xavier Tytelman.

“It’s like flying over the sea.”

May’s average of 50 planes cutting through Afghanistan each day skyrocketed to around 280 after June 13, when the Iran-Israel war erupted, data from tracking website Flightradar24 showed.

Since then, in any given day, more than 200 planes often traverse Afghanistan — equivalent to roughly $4.2 million a month, though this figure is difficult to verify as the authorities do not publish budgets and have declined to comment.

Opaque transactions

While not a princely sum in terms of government revenue, the overflight fees offer a much-needed boost to Afghanistan’s coffers as it contends with a massive humanitarian crisis and a war-battered economy.

Around 85 per cent of Afghanistan’s population lives on less than one dollar a day, according to the UN, and nearly one in four Afghans aged 15 to 29 are unemployed.

The World Bank says overflight fees contributed to modest growth in Afghanistan’s economy in 2024, before the route began attracting carriers needing to bypass Iran.

International airlines returned to Afghanistan starting in 2023, with Turkish Airlines, flydubai, and Air Arabia making almost daily flights from Afghan airports.

Others, such as Singapore Airlines, Air France, Aeroflot, Air Canada and Swiss Air, fly over Kabul, Mazar-i-Sharif or Kandahar — as practicality outweighs the risks, which remain.

Consultant Tytelman warned that Afghanistan is still a less than ideal place to land in case of technical or medical emergencies, with potential complications due to a lack of spare parts and dilapidated health care services.

Yet he noted, “planes are landing in Kabul every day”.

Airlines were loath to discuss the mechanics of paying the Taliban government, which remains isolated by many countries in part over its restrictions on women.

Multiple companies contacted by AFP said they do not provide overflight payment information.

Afghanistan’s aviation officials did not respond to multiple requests for comment, and would not confirm the overflight fees or the process by which they are paid.

“Companies are not formally prohibited from trading with Afghanistan, as US sanctions target only certain Taliban officials,” a World Bank expert told AFP, speaking on condition of anonymity.

However, “some abstain out of fear of being associated with the ruling power”, he added.

Industry insiders speaking on condition of anonymity said the $700 overflight fees are paid to third-party intermediaries, such as the United Arab Emirates-based GAAC Holding, which manages airports in Afghanistan, or overflight brokers.

Some airlines may now even pay directly, as more countries develop diplomatic ties with the Taliban government.

Reinforcing authority

Only Russia has officially recognised the Taliban authorities, who are hamstrung by frozen assets, sanctions on individuals and a lack of trust in the banking sector.

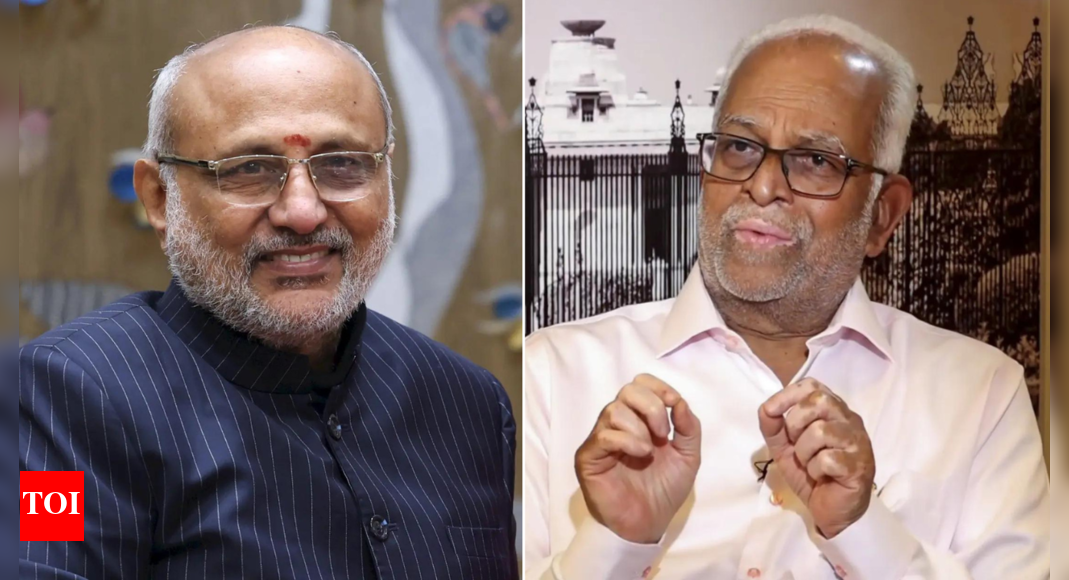

Against such economic headwinds, the airspace revenue stream “is helpful for the cash-strapped current administration”, said Sulaiman Bin Shah, former deputy minister of industry and commerce in the ousted government and founder of the Catalysts Afghanistan consultancy.

But Bin Shah emphasised that the overflight traffic offers more than just financial benefits, as it increases normalisation of the Taliban authorities.

“It reinforces their grip on state functions and supports the image of a functioning government, even without formal international recognition,” he said.

“So while the income itself is not transformative, it plays a meaningful role in the administration’s economic narrative and political positioning.”