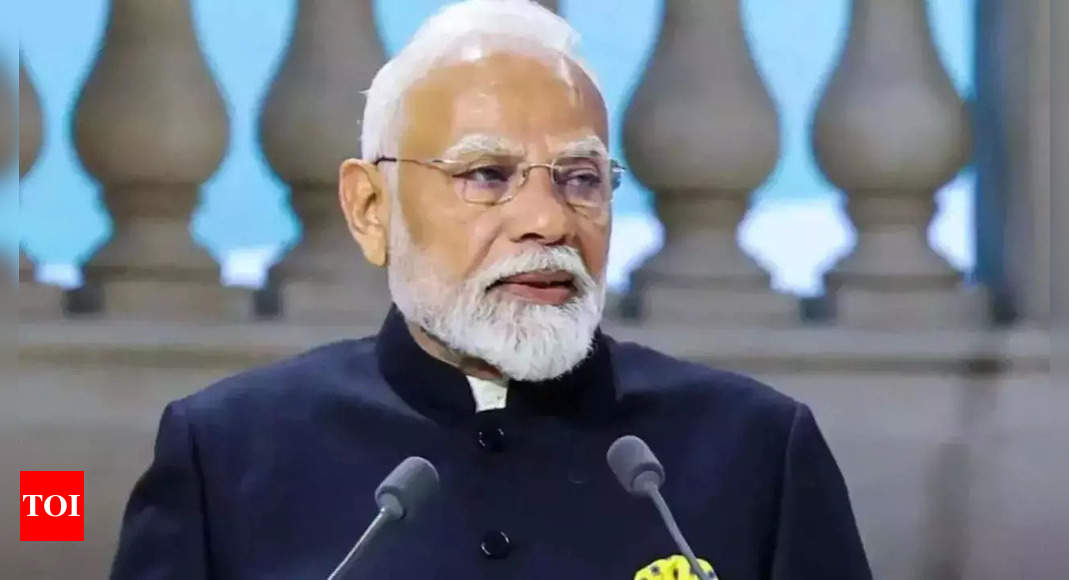

Union Budget 2025 | No income tax payable on income up to ₹12 lakh, says Nirmala Sitharaman

In the most anticipated announcement this budget, Finance Minister Nirmala Sitharaman announced there would be no income tax for incomes up to ₹12 lakhs. She termed it as commitment and trust on the middle class. Effectively, under the new tax regime considering the erstwhile standard deduction of ₹75,000, income of up to ₹12.75 would have no income tax liability.

The move comes in after prevalent consensus in the industry and populace at large about increasing aggregate consumption in the economy. “The new tax structure will substantially reduce the taxes of middle-class and leave more money in the hands of the middle class and boost consumption.”

Enumerating revisions in tax slabs, the finance minister informed that incomes up to ₹4 lakhs would not be taxed, ₹4 to 8 lakhs would host 10% taxation rate, ₹12-16 lakh 10%, ₹16-20 lakh 20%, ₹20-24 lakh 25% and incomes above ₹24 lakh 30%.

A tax payer in the new regime with an income of ₹12 lakh will get a benefit of ₹80,000 in tax. A person having income of ₹18 lakh will get a benefit of ₹70,000 in tax. A person with an income of ₹25 lakh gets a benefit of ₹1.10 lakh.

The Rajya Sabha MP is presenting her eighth budget on Saturday (February 1, 2025) – taking her closer to the record ten budgets presented by former Prime Minister Morarji Desai during his lifetime.

Published – February 01, 2025 12:51 pm IST